Section 108 Loan Guarantee Program

The Community Development Block Grant (CDGB) program, with the stated goal of providing affordable housing, anti-poverty programs, and infrastructure development to economically underserved communities, was established through the Housing and Community Development Act of 1974. The law was a response to a funding moratorium placed on the Department of Housing and Urban Development (HUD) programs by the Nixon administration in 1973.

The 1974 Act replaced the original seven HUD programs with a single grant program that directly allocated funds to local urban and rural communities and to states based on their population. The purpose of the funds, to develop comprehensive solutions to complex local housing and economic development needs, did not change. But the CDBG program transferred the decision-making power of which projects to fund from federal administration into the hands of local governments, which were more familiar with their local needs.

The CDBG program, which is appropriated close to $3.4 billion annually, was broadly supported because the federal administration of the program often resulted in program benefits not reaching the targeted low-income communities. The federal administration also diminished the potential for attracting widespread private investor participation in the program.

The CDBG program recognized that low-income communities did not always possess the ability to influence the local urban and state political decision-makers granted the authority to provide grants from the CDBG program funds. Therefore, the CBDG program included small set-asides that provided grants to minority-serving universities (Section 107) and for large-scale rehabilitation loans to underserved communities (Section 108). These set-asides gave low-income communities a means of more direct access to requesting funding to meet their needs.

Historically Black Colleges and Universities (HBCUs), as minority-serving universities, are provided direct grant funding of about $7 million annually under Section 107 set-aside. On average, seven of the 106 HBCUs receive these grants annually to fund a variety of activities related to the objectives of the HUD Office of University Partnerships.

HBCUs qualify for the Section 108 Loan Guarantee Program, which leverages CDBG program grants in order to attract private investor participation in building large-scale renovation and new construction. Section 108 often provides the security necessary to catalyze investment from private lenders and is typically used to fill gaps in financing larger development projects.

Large urban or state governments are given direct access to the Section 108 Program, while smaller rural communities get access to the program through their state governments. Therefore, to gain access to Section 108 program funds, HBCUs are required to work in partnership with their local urban, rural, or state governments that receive an annual allocation of CDBG program funding for their communities.

Local urban, rural, or state governments may apply for up to five times their latest approved CDBG allocation amount, minus any outstanding Section 108 commitments and/or principal balances on Section 108 loans. This is an advantage to HBCUs and low-income communities that undertake an improvement project with required financial needs that exceed the amount of an approved CDBG program grant from a local government entity.

The HBCU, the local government, and HUD Section 108 Loan Guarantee Program work together to develop an application for an amount that is greater than the grant amount. While it requires additional work, approval from HUD Section 108 Loan Guarantee Program can be leveraged to attract additional private sources of funding because the terms of Section 108 funding include up to 20-year terms, the option of making interest-only payments, and flexible collateral requirements.

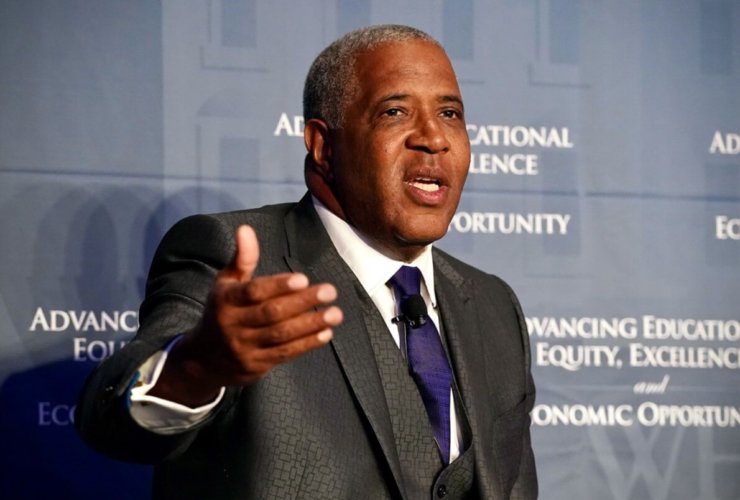

The HBCU Community Development Corporation is ready to assist your HBCU in preparing a development plan for Section 108 approval.

If your HBCU needs assistance getting started, contact us at www.hbcucdc.com.